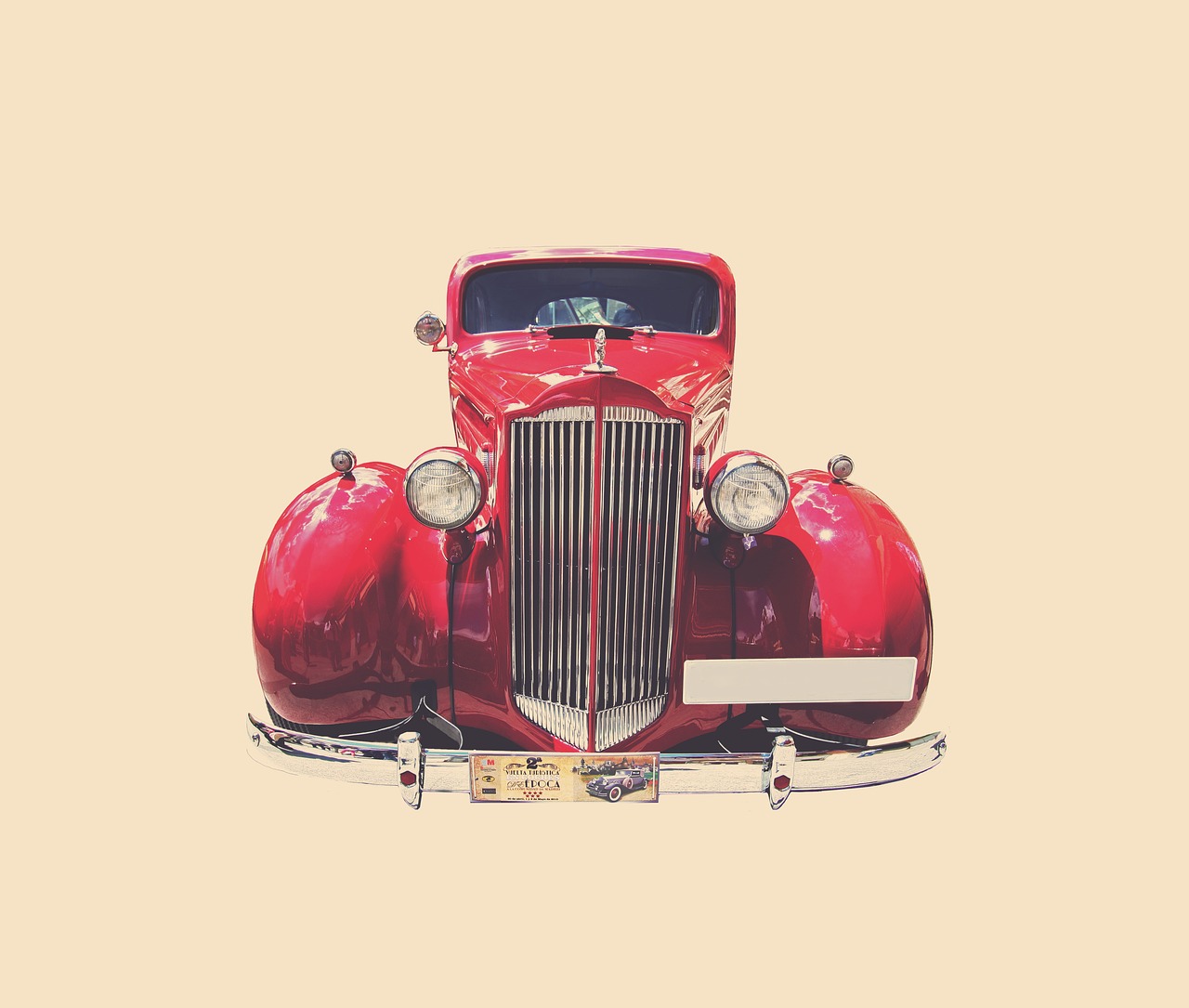

Motor Insurance, also called vehicle insurance is necessary to buy trucks, scooters, cars, bikes, etc. This insurance is compulsory that offers cover if your vehicle gets physically damaged, lost, or theft, etc. due to human-made or natural disasters.

People save every penny to purchase a vehicle to speed up their rides for work and personal needs. On the other hand, any mishap can happen anywhere without any acknowledgment due to which the individual might have to face a lot of damage to their vehicle and have to pay a huge amount for the repair costs or replacement of the same. Therefore, it is crucial to have motor insurance for your vehicle so as to provide full safety and security.

Motor insurance broadly provides two types of cover:-

- Comprehensive cover which provides for loss or damage to the insured (own) vehicle & also provides for third-party liability

- In case of accidental damage to the motor vehicle, the policyholder should immediately inform the nearest office of the insurer.

- Thereafter, he is required to submit the claim form along with a copy of the Registration Certificate of the vehicle, the driving license of the driver of the vehicle at the time of the accident, an estimate of the repairs required, and other documents as mandated by the insurer.

- In case of theft of the vehicle, the owner must immediately lodge a First Information Report (F.I.R) with the police and submit the Final Police Report to the insurance company as soon as it is received.

- Once the claim is approved by the company, the Registration Certificate of the vehicle is to be transferred in the name of the company, keys of the vehicle have to be handed over to the company, and a letter of Subrogation and Indemnity, on a stamp paper duly notarized, is also to be submitted for settling the claim.

- Liability cover which provides only for third-party liability

- Third Party Liability cover only provides indemnity to the insured, in the event of an accident caused by the use of the motor vehicle. In such a cover, the insured is liable to pay for:-

- Death or injury to any person, including the occupants of the motor vehicle

- Damage of property that does not belong to the insured

- In case of third-party liability, the policyholder must immediately inform the insurance company of the incidence likely to give rise to a liability claim.

- A claim form, duly filled in, along with copies of the Registration Certificate, Diving License, and FIR is to be submitted to the insurance company at the earliest.

- If any summons is received from Court, the same should also be sent to the insurance company immediately.

- Third Party Liability cover only provides indemnity to the insured, in the event of an accident caused by the use of the motor vehicle. In such a cover, the insured is liable to pay for:-